Introduction

The devastating consequences of the COVID-19 pandemic—with millions out of work, hungry, and at risk of losing their homes—exposed the fault lines of our economy. Decades of disinvestment in families and communities decimated our public health system, put corporations over workers, and have made necessities like housing and child care unaffordable. Black and brown communities have been disproportionately affected by these policy choices.

In response, Congress passed and President Biden signed the American Rescue Plan (ARP) to address the impacts of the pandemic and put the country on a path toward an equitable recovery. The State and Local Fiscal Recovery Funds (SLFRF) program was established to provide resources to boost state and local economies and direct resources to households, businesses, and nonprofits in communities that were hurt the worst by the pandemic.

Across the country, SLFRF funding is being leveraged to do exactly that. Driven by the dedication of community organizers and advocates, and the commitment of courageous and forward-thinking officials, unprecedented investments are being made to strengthen public services, address our most pressing problems and create new opportunities.

The flexibility provided under the rules for SLFRF funds is intended to ensure local communities have a say in the programs they need most. Unfortunately, special interests have taken advantage of this flexibility to fund projects that fail to address pressing hardships. And in some cases, officials are actively flouting the intent of the program to finance their pet projects, like highways and prisons.

The difference comes down to us. Organizing and advocacy are essential to ensure that SLFRF funds serve those most in need. Policymakers and community groups who want SLFRF funds to impact their communities must get involved and fight for it. Together, we can lead the way toward the equitable recovery we deserve.

Allowable Uses and Examples

State and Local Fiscal Recovery Funds (SLFRF) can be used for four key objectives:

Responding to the economic and public health impacts of COVID-19

Activities to directly combat the pandemic and support families and businesses that were harmed economically are critical to our immediate and long term recovery. The program allows for expenditures to fight COVID, including paying for testing and vaccines, as well as dealing with the costs of mask mandates or related policies. Funds can also be used to respond to the broader health impacts of the pandemic by improving public health systems, strengthening access to mental health services, and supporting community-based approaches to reduce violence and promote behavioral health. This category also provides for direct assistance to people, nonprofits, or businesses suffering economically from the pandemic. Services intended for people or communities with low incomes—housing, cash assistance, food, health care, job training and more—are all allowable. Under this provision, states and localities can restore critical public-sector jobs that have been cut over the last decade.

Providing premium pay for essential workers

Workers in frontline jobs who were unable to work remotely during the pandemic can be provided with premium pay, also called hazard pay or hero pay. Both public-sector and private-sector workers who meet the income requirements under the rules are eligible. That means grocery store staff, child care providers, hospital workers, bus drivers, and others in addition to public servants—everyone who played a vital role to keep the economy going during the pandemic—are eligible to receive direct cash payments.

Replacing lost public sector revenue

It’s taken years for local and state governments to recover from past economic crises, and the communities hit hardest are typically the last to recover. To reverse this dynamic, SLFRF funds can be used to cover budget shortfalls from lost tax revenue that would otherwise lead to cuts in government services. Recipient governments can either calculate their revenue loss or apply up to $10 million in SLFRF for revenue replacement. This money does not need to replace the exact services or personnel that were impacted by revenue loss. Instead, spending under this provision can be for any regular government service.

Investing in water, sewer, and broadband infrastructure

This category allows governments to invest in projects related to drinking water and treatment of sewage waste, as well as conservation and watershed protection. It can also be used to invest in projects designed to deal with climate change. Additionally, SLFRF can be used to expand internet access in areas without reliable broadband service, as long as broadband providers participate in a program that subsidizes services for low income residents.

“The American Rescue Plan Act of 2021 established the Coronavirus State and Local Fiscal Recovery Funds to provide state, local, and Tribal governments with the resources needed to respond to the pandemic and its economic effects and to build a stronger, more equitable economy during the recovery.”

—Department of the Treasury under the Biden Administration (“Coronavirus State and Local Fiscal Recovery Funds; Final Rule”, Federal Register, Vol. 87, No. 18, Thursday, January 27, 2022, Rules and Regulations, Page 4338.)

Allocation Amounts and Payment Timing

$350 billion in State and Local Fiscal Recovery Funds (SLFRF) are flowing to communities across the country. States, cities, counties, tribes and territories receive their funds directly from the U.S. Treasury, while smaller towns and villages may receive money that was directed by the Treasury to their states to be passed along. You can find out how much your state, city, county, tribe or territory is receiving by using the buttons on the right side of this page. If you live in a smaller community, your state should have published a list of all municipal recipients and the amounts they received.

Some states, all tribal governments, and all territories received their allocations of SLFRF in one payment in the spring of 2021. The remaining states, all counties, and all cities received half of their SLFRF in 2021, with the second half coming 12 months later, in spring 2022.

No matter when the funds were received, all recipients have until December 31, 2024 to “obligate” their SLFRF funding (that is, to decide how their allocation will be spent), and until December 31, 2026 to actually spend down the funds. This extended timeline recognizes that addressing our communities’ most pressing problems can take years, and gives states and localities time to engage their constituents and have their voices inform policy decisions in order to lay the foundation for an equitable recovery.

Find out how much the U.S. Treasury has allocated to your state or community

SLFRF Spending Trackers

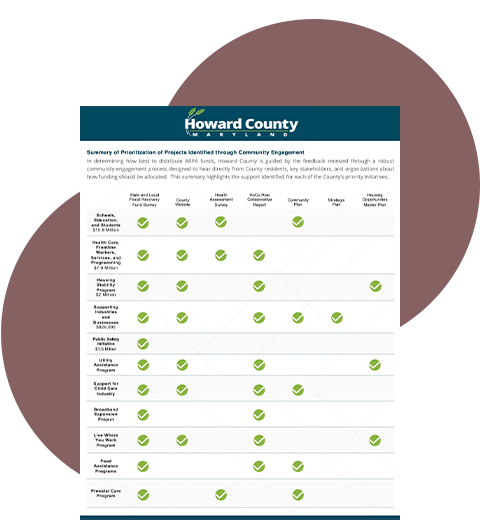

While states and localities have lots of time to decide how to spend their SLFRF funds, many have already started putting the funding to work. Some entities started tracking these spending decisions last year, and the databases they created can be useful to identify ideas and models that you can share with your own elected officials, or even to learn how local officials might have already spent SLFRF funds. The following sites can help you identify spending decisions for states and localities. Grantees are also required to report their spending decisions to the Treasury Department, and you can learn more about those reports and how to find them here.

Local Government ARPA Investment Tracker

Shows data on how local governments in cities and counties with populations over 250,000 are spending SLFRF. Data comes from Recovery Plan Performance Reports. Partnership of the National League of Cities, Brookings Metro, and the National Association of Counties.

Center on Budget and Policy Priorities Tracker

Focuses on states and territories. Breaks down state appropriations into clear categories, allowing for easy comparison across states.

National Conference of State Legislatures (NCSL) Tracker

Focuses on states and territories. Allows users to focus on selected states and types of spending. Includes links to relevant legislation or executive orders.

COVID-19: Local Action Tracker

Has information from all sorts of local governments, gathered from public news sites and direct submissions from governments. Has ARPA information as well as data from 2020 COVID legislation. Because the data is often just a news story, follow-up is necessary to verify information. This tracker stopped collecting new information in February 2022, and will not be updated. Created by Bloomberg Philanthropies and the National League of Cities.

Locating Government SLFRF Plans and Reports

To assess how State and Local Fiscal Recovery Funds (SLFRF) are being used, and to monitor grantees’ compliance with the spending rules that apply to SLFRF, the Treasury Department requires that grantees submit a number of reports:

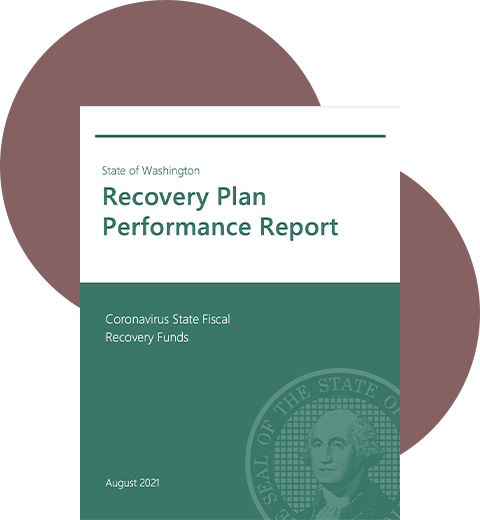

States as well as all cities and counties with more than 250,000 people must publish annual Performance Plan Recovery Reports on how they will use their SLFRF.

All states, localities, tribal governments and territories must submit Project and Expenditure Reports detailing the projects being funded with SLFRF and the progress implementing them. Every grantee was required to submit a Project and Expenditure report to the Treasury Department by April 30, 2022. Depending on grantees’ size, they must submit these reports on an ongoing basis, either quarterly or annually. Grantees are not required to share these reports publicly, but the Treasury Department has been releasing composites of the data from the reports (although after some delay, so the data may not be up to date).

Finding these reports will help you advocate for better SLFRF spending in your community. You can use the Treasury Department’s compilations to figure out not only which projects are being supported, but also to determine how much funding is still available that you can help shape.

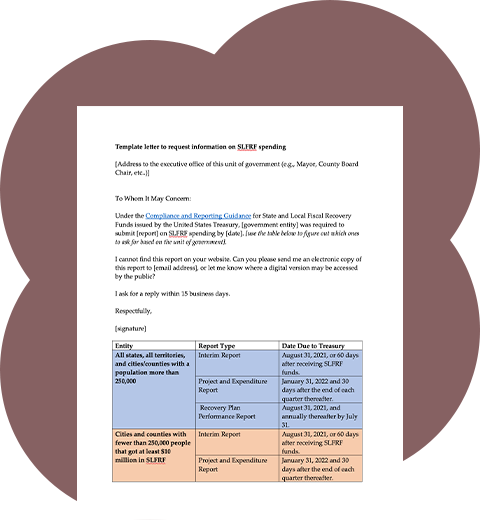

How to request a plan or report

In some cases, reports cannot be found on the Treasury Department website or other public channels such as a government website. For more information, see this overview of the challenges of ARPA transparency by Good Jobs First.

Below is a template letter that can be used to ask state and local governments for their reports if the reports for your community have not been made easily accessible. The template includes a list of all the reports various entities are required to submit, and the dates by which they are to be submitted.

How to read reports

The reports submitted to the Treasury Department are required to include the information listed below. If they don’t, you can push your policymakers to improve their reports. Full reporting requirements can be found on the Treasury Department website.

Annual Recovery Plan Performance Reports

These reports should include:

- A high-level summary of the grantee’s plans for SLFRF

- A list of all projects funded

- How the grantee will meet key SLFRF purposes, such as improving public health or responding to COVID’s negative economic impacts

- How the plan promotes equitable outcomes

- Evidence the grantee used to make spending decisions

- Community engagement plans

- Outputs and outcomes, such as number of people served or number of housing units built

- Expenditures to date

Project and Expenditure Reports

These reports are annual or quarterly depending on jurisdiction size. The reports should include:

- A list of projects and how much funding has been budgeted and obligated for each

- The status of each project (that is, how much has been completed) and expenditures to date

- For each project, whether it targets a specific group impacted by the pandemic

- Project grantees and sub-grantees